Wednesday, August 28, 2013

Saturday, February 13, 2010

Fixed and variable costs

One of the keys concepts in managing a business is the understanding of fixed and variable costs and how they can be used in practical applications. This article will define the terms using specific examples from the hotel industry.

The basis for each example is a hotel with 100 rooms.

If there are 50 guests, they will use 50 soaps (one would hope). If there are 60, then 60 soaps would be used.

Fixed costs are costs that are independent of output. These remain constant throughout the relevant range and are usually considered sunk for the relevant range (not relevant to output decisions). Fixed costs often include rent, buildings, machinery, etc.

Variable costs are costs that vary with output. Generally variable costs increase at a constant rate relative to labor and capital. Variable costs may include wages, utilities, materials used in production, etc.

In accounting they also often refer to mixed costs. These are simply costs that are part fixed and part variable. An example could be electricity--electricity usage may increase with production but if nothing is produced a factory still may require a certain amount of power just to maintain itself.

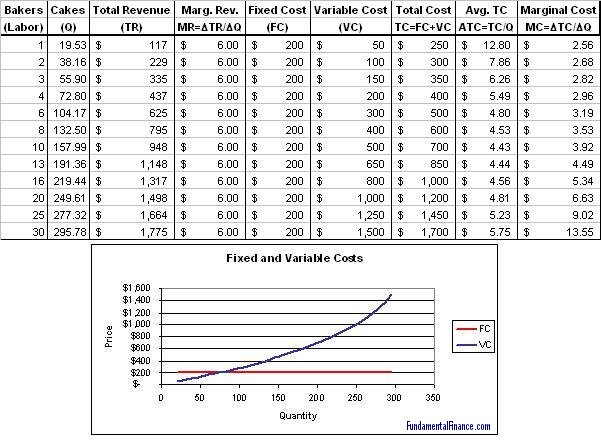

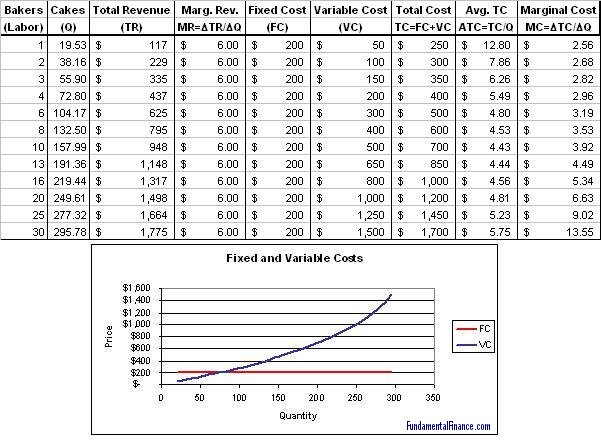

Below is an example of a firm's cost schedule and a graph of the fixed and variable costs. Noticed that the fixed cost curve is flat and the variable cost curve has a constant upward slope.

The basis for each example is a hotel with 100 rooms.

Variable Cost

Variable costs are the total expense changes as volume changes. Room supplies are a common variable cost. The supplies are directly related to the number of rooms that are filled.If there are 50 guests, they will use 50 soaps (one would hope). If there are 60, then 60 soaps would be used.

Fixed Cost

Costs are identified as fixed if they do not change as volume changes. For instance, a late night registration desk would be attended by one person, whether there was one guest or one hundred.Variable Costs and Fixed Costs

All the costs faced by companies can be broken into two main categories: fixed costs and variable costs.Fixed costs are costs that are independent of output. These remain constant throughout the relevant range and are usually considered sunk for the relevant range (not relevant to output decisions). Fixed costs often include rent, buildings, machinery, etc.

Variable costs are costs that vary with output. Generally variable costs increase at a constant rate relative to labor and capital. Variable costs may include wages, utilities, materials used in production, etc.

In accounting they also often refer to mixed costs. These are simply costs that are part fixed and part variable. An example could be electricity--electricity usage may increase with production but if nothing is produced a factory still may require a certain amount of power just to maintain itself.

Below is an example of a firm's cost schedule and a graph of the fixed and variable costs. Noticed that the fixed cost curve is flat and the variable cost curve has a constant upward slope.

Subscribe to:

Comments (Atom)